Richardson Electronics ($RELL)

Buying Semi Growth for Free: A Net-Cash Microcap Trading at Liquidation Value.

Thesis Summary

V-shaped recovery in high-margin semiconductor wafer business; projecting 100% revenue growth ($20M to $40M) with significant operating leverage.

GES segment driving double-digit growth, fully exposed to massive secular themes: Grid Modernization, Energy Storage (ESS), and Wind Energy.

Strategic divestiture of unprofitable Healthcare unit complete; removal of margin drag creates a structural profitability tailwind beginning Q4 FY2026.

Trades at <1x Sales, 1x Tangible Book, and <8x Normalized Earnings with adjacent peers trading multiples higher

One Small Ask:

I work full time as an engineer and spend a lot of my free time researching and working on these writeups

If you find value in this article, consider dropping a like and sharing :)

It goes a long way in getting my content out there to more people.

Disclaimer: I own shares of Richardson Electronics ($RELL) at an average cost basis of $11.43. This write-up is for informational purposes only and does not constitute investment advice.

It’s rare nowadays that I get the “asymmetric itch” when researching a new stock. With the market at all-time highs and valuations elevated, most names are missing at least one key ingredient of a true “fat pitch.”

I look for four criteria:

Significant Downside Protection: Supported by tangible assets and a clean balance sheet (trading close to TBV or NCAV). Even if my thesis is wrong, permanent capital loss is unlikely.

Proven Earnings Power: A history of proven earnings power currently obscured by cyclicality or “temporary” issues. (Note the word temporary - need to be confident this is the case).

Clear, Hard Catalysts: Visible short-to-medium term events that will significantly inflect earnings and force a market re-rating.

Asymmetric Upside: A realistic path to at least 2–3x the stock price in <2 years.

I believe Richardson Electronics fits the bill for all four, and I have made it my largest position heading into 2026.

Business Overview:

Richardson Electronics is an electronics component manufacturer, designer, and distributor. A 79 year old company they focus on niche end markets and industries with minimal competition and provide specialized “engineered solutions” to their customers.

They are executing a strategic pivot from a traditional logistics-focused distributor to a vertically integrated provider of 'Engineered Solutions.' By designing and manufacturing proprietary products to solve specific customer challenges, RELL captures higher value-add and deeply integrates itself into client product cycles. This entrenchment creates a wide moat, significantly increasing switching costs and supporting superior long-term margins.

Essentially companies come to them asking them to design a “specialized” device to solve some problem for them. With over 100s of engineers, RELL gets to work designing potential solutions, most go no where but occasionally they hit homeruns and are able to successfully commercialize and grow the solution.

After divesting their money losing healthcare business in 2025, they now operate in three segments moving forward:

1. Power & Microwave Technologies (PMT)

This is the largest business unit within Richardson Electronics. This segment consists of the legacy Electron Device Group (EDG) which contains the power grid tube and semiconductor wafer fab business. Major customers in the fab business include: LAM, MKS, Tokyo Electron, and Applied Materials. RELL considers themselves “exclusive” in the products they make and sell. The other part is Power and Microwave group (PMG) which is newer and focuses on 5G related components such as RF, wireless semiconductors, modules and power components. They focus on component distribution in this segment and work with technology partners such as Qorvo and Maycom. The repaired Siemens CT X-ray tubes part from the divested healthcare business was also retained under this segment.

2. Green Energy Solutions (GES)

This segment is the primary driver of revenue growth and their newest segment. Born as a pet project within the PMT division, the business was launched into a separate business unit in 2023 once commercial sales started taking off. The core revenue generator is the Wind Energy business, anchored by the ULTRA3000 pitch energy module. This module is a drop-in replacement for standard lead-acid batteries in wind turbine pitch systems. There is a clear value add for customers as while traditional lead-acid batteries fail every 6–24 months due to environmental stress, RELL’s ultracapacitor modules have a service life of 10+ years. This reliability significantly reduces downtime and eliminates hazardous maintenance costs for operators, securing a long-term retrofit cycle for the company. Since the ULTRA3000 was tailored for GE turbines, RELL has recently launched the ULTRAPEM which allows them to cover all other OEM turbines - a significant tailwind going forward.

In addition to wind, they also pursue opportunities in EV locomotives and synthetic diamond manufacturing. In the rail sector, the company is transitioning from beta testing to production orders with major partners like Progress Rail (Caterpillar), supplying “StartSaver” modules to replace legacy starter batteries in diesel-electric locomotives. Concurrently, the industrial division applies the company’s legacy microwave expertise to power Chemical Vapor Deposition (CVD) reactors, which are critical for manufacturing synthetic diamonds.

One important thing to note is that GES has zero exposure to offshore wind development. They focus exclusively on retrofitting the existing global fleet of onshore turbines, hence the business remains insulated from subsidy volatility and relies on mandatory maintenance expenditures rather than discretionary government infrastructure spending. While the current Administration has moved to block new offshore wind projects due to a general distaste for the sector, RELL faces zero impact from this as they are 100% aftermarket.

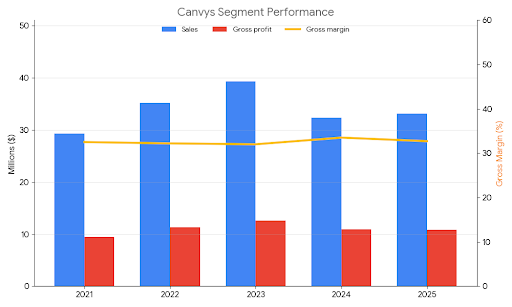

3. Canvys

The stable and less “sexy” part of the business. Canvys manufactures custom display solutions for Original Equipment Manufacturers (OEMs) in the medical, industrial, retail, and transportation sectors. Unlike standard monitor distributors, Canvys engages in deep engineering collaboration to modify off-the-shelf panels or design fully custom units that meet strict regulatory standards such as surgical suites and patient monitoring systems.

Snapshot:

Price: $11.36

Market Cap: 164.92M

Shares outstanding: 14.3M

Enterprise Value: 131.07M

Tangible Book Value: $11.05

P/TBV: 1x

Why does this opportunity exist?

1. Cyclicality in Semi-fab business

The core focus of my thesis surrounds the Semiconductor Wafer Fabrication Equipment (WFE) support business embedded within the PMT division - more specifically the Electron Device Group (EDG) part. Crucially, RELL does not manufacture the silicon wafers; instead, they manufacture RF power tubes and microwave generator that are critical for the etch and deposition processes used to manufacture semiconductor wafers (Basically they make the things that go into the things that make the chips)

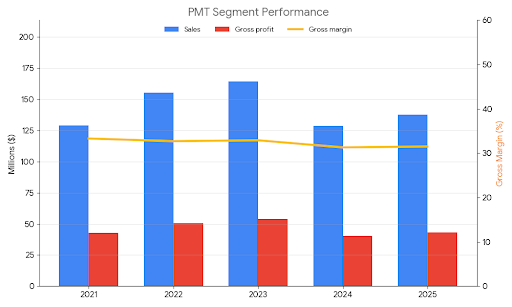

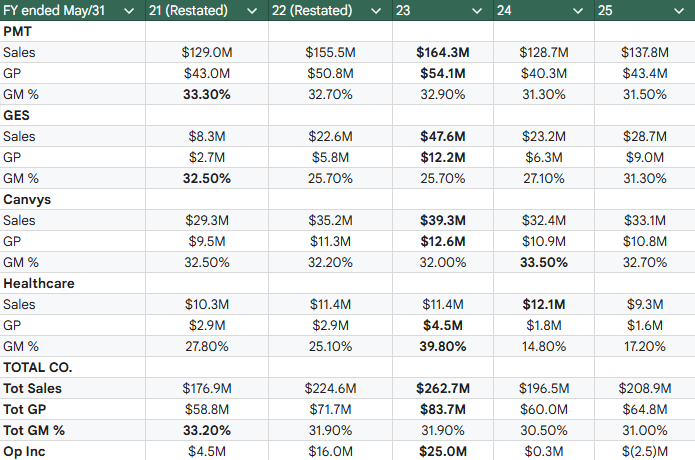

The semi fab business within the PMT division has historically been a very cyclical business. In the table above, you can see the massive drop in PMT sales from 2023 to 2024.

“Fiscal 2024 was a difficult year for Richardson Electronics, as a result of challenging conditions within our semiconductor wafer fab market... Sales decreased $35.6 million or 21.7% for PMT... primarily due to lower sales of manufactured products for our semiconductor wafer fabrication equipment customers.” — FY2024 Earnings Press Release (July 24, 2024)

Management doesn’t explicitly break out the sales for the semifab business but share tidbits in PRs and earnings call that give you some context directionally of how the business is doing. During the global chip shortage in 2022-2023 they experienced a strong upcycle in this business as the components they manufactured were in high demand as they were critical to build the equipment used for making these chips. Around Q4 2023, they started experiencing the softening demand in this segment as similar to a lot of industries coming out of covid customer inventories had overshot expectations and destocking was necessary to chew through this excess inventory slamming RELL’s PMT sales in the process.

Why is this changing?

With AI creating another massive boom in semi demand, the company has sharply rebounded from its trough semi fab sales with management forecasting returning to peak semi sales and even higher. The company saw an unprecedented V shaped recovery in this business after experiencing the trough in Q2 of FY2024.

However, we saw semi-fab demand increase during the quarter as we experienced higher shipments and bookings. In fact, Q4 FY 2024 was our largest revenue quarter this year for the semi-wafer fab business, up 71% over Q3. We expect to see year-over-year growth for our semiconductor wafer fabrication equipment business in FY 2025, based on customer feedback and market predictions. - Q4 FY 2024 Earnings Call

Management continues to be extremely bullish on the incoming demand in the 2H of 2026 and beyond as demonstrated in their most recent earnings call:

Finally, we are expecting stronger demand for our engineered solutions within the semiconductor wafer fab equipment market well into calendar year 2026 and beyond. This growth is tied to the ongoing benefit of AI on equipment demand throughout the world. We are well positioned to benefit from growth in memory-related applications. This growth takes advantage of our existing resources and manufacturing facilities as well. - Q2 FY 2026 Earnings Call

So as I mentioned, we're starting to see stronger forecasts for our Q3 and Q4. Bear in mind that the forecasting is not always the best, and it tends to bounce around a lot, as we've been discussing really for the last couple of years. But we do see, again, across multiple customers within that channel, their input to us is, "Get ready. We are ready. We have the resources. We have the space. It's not going to cost us a lot of money in terms of realizing upside." I also want to point out that on a year-to-date basis, so Q1, Q2, we're still up considerably over prior year's first two quarters. So we are cautiously to more than cautiously optimistic about Q3 and Q4, and we're ready. So I don't know if that answers your question. - Q2 FY 2026 Earnings Call

Now the really nice part is that RELL openly discloses their customers in the semifab business. They are the primary and sole supplier to LAM research a steady relationship they have had since 2006 when Novellus was sold to LAM. They sell about 100+ devices to LAM including microwave devices (imagine a 36-inch stainless steel ring) that run for around $30k a piece. They also sell to Tokyo Electron, MKS, and Applied Research but prefer LAM’s business over the latter as they directly compete. Here’s a nice quote to give you some idea of the scale of the business:

What we are seeing is a pickup in the semi-fab equipment manufacturing business. You know, we follow LAM’s quarterly vendor meetings and listen to them, and they’re talking about a very positive increase in their business going forward. In the best year, we did about $40 million with LAM and people in that business. I think right now we’re running in the low $20 million, Wendy, somewhere. We see an opportunity to grow substantially in that business going forward. - Q1 2026 Earnings Call

LAM research reported Q4 2025 financials recently beating and raising guidance. Most importantly management forecasted a substantial increase in WFE spending, projecting it to reach approximately $135 billion in CY 2026, up from an estimated $110 billion in CY 2025. This growth is actually “constrained” due to a shortage in clean room storage which is pushing the bulk of this into 2H of 2026 as customers cant build their tools enough. For context, the previous peak for WFE spend was 2022 ($95-100B) which as we discussed RELL greatly benefitted from and now we are looking at a conservative 30%+ increase to that figure in 2026.

Now I wont hold your hands here too much as I think you can put two and two together but take a look at how RELL 0.00%↑ has traded comparatively to LRCX 0.00%↑ in the chart above. Quite frankly I don’t think the market has digested this story at all and I fully believe the semifab business should easily return to its previous peak and exceed it. The capacity is already in place and the business has tremendous operating leverage at scale which should flow down to the bottom line and create a huge spike in earnings when realized.

2. Healthcare losing money

In June 2015, Richardson Electronics bought IMES (International Medical Equipment and Service) for $8.5M which birthed their healthcare division.

From the words of Wendy Diddell their COO it was a “challenging business that did not materialize the way they wanted it too.”

They wanted to service tubes as well as make them creating a proprietary X-RAY CT tube called the ALTA750. Even proudly claiming this in a 2018 Investor Presentation:

“Our Future is Healthcare: we’ve invested more than $35 million since 2015”

They targeted 40%+ gross margins on this tube business but struggled to hit the scale necessary to break even on this division pushing the goalposts every year until finally volumes collapsed in 2024. For most of its inception, the healthcare segment contributed <10% of sales and skirted around the mid 20%s in gross margin essentially diluting overall margins while contributing very little sales.

Why is this changing?

RELL finally gave up on this business in 2025, selling majority of their healthcare assets to DirectMed imaging for $8.2M. Retaining a small profitable piece of the Siemens Tube Repair business in PMT. However, they still have a supply agreement they entered where they have to supply certain CT X-ray tubes until its completion in Q4 of 2026/Q1 of 2027.

Okay. So this is Wendy. Year-to-date, the overall hit to the gross margin in PMT has been almost negligible. It’s about a 0% gross margin, so we’re not experiencing a huge hit there. It’s the addition of the SG&A. And on a year-to-date basis, while we’re doing better than we anticipated with that, we still are losing money. As we mentioned in the call, we anticipate finishing up the ALTA tube production in the third quarter. And when we conclude that, and we’re focusing then strictly on the repair of the Siemens tubes. We expect that to turn to a profitable bottom line contribution. So I’m estimating, we’re estimating at this point that, that will begin in Q1 of FY ‘27, but we’re going to do everything we can to pull that into Q4. - Q2 FY2026 Earnings Call

Despite have no effect on their gross margins, there is still a drag on the bottom line due to remaining overhead in SG&A on this supply agreement. The nice part is this margin boost could align nicely with the inflecting semi business to further increase earnings going into 2H of 2026 and into 2027. So it presents a nice opportunity for the “badco” to fully roll off the books and improve numbers.

Just to give some additional context here are the op losses for the healthcare business from 2022-2024:

FY2022: -5.5m

FY2023: -3m

FY2024: -3m (Just under 3m according to Q4 2024 call, lets just say 3m)

From 2027 onwards, this will be completely gone which should add a ~$0.15+ boost to EPS.

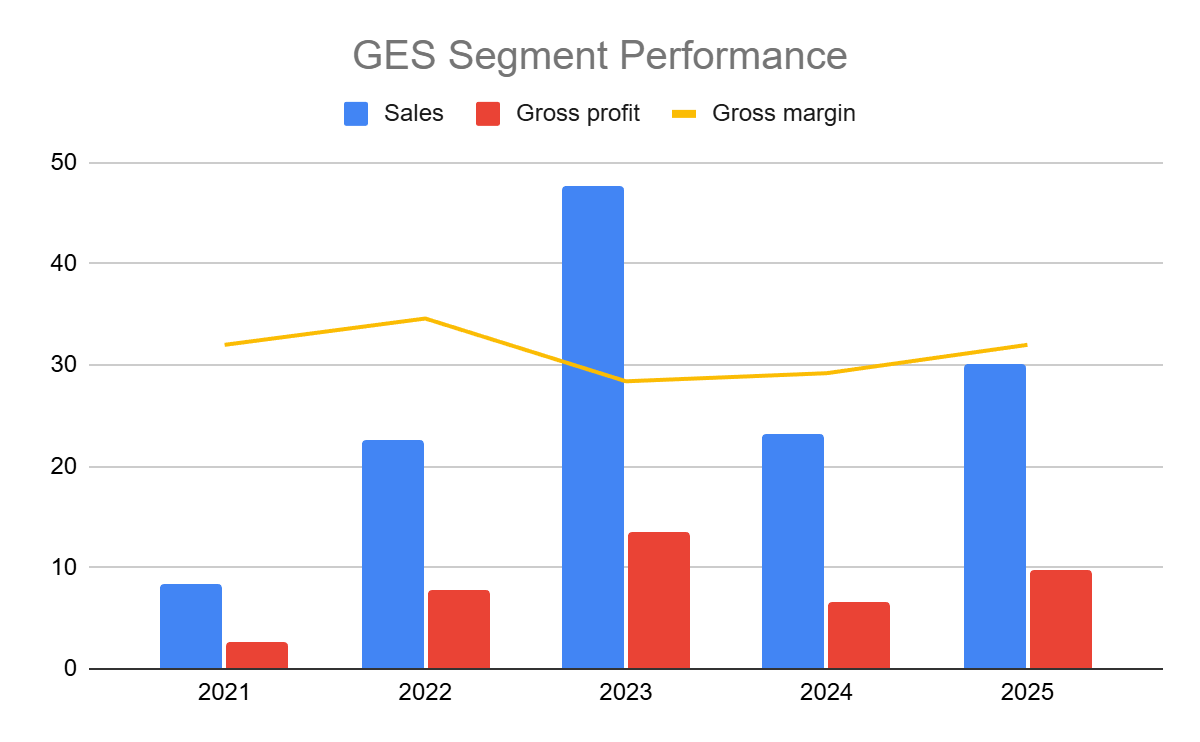

3. Lumpiness of projects in GES

The main thing I will point out here is that the GES segment had a 51% drop off in sales from 2023 to 2024. Now at first glance this is probably alarming to investors but digging deeper it was the result of a combination of non-recurring “lumpy” large orders and project delays, rather than anything affecting the long-term prospects of the business.

“GES sales decreased $10.6 million from last year’s fourth quarter, which included a large sale of EV locomotive battery modules that did not recur in fiscal 2024.” — FY2024 Earnings Press Release (July 24, 2024)

“Replacement of lead acid batteries in existing wind turbines is often project-based and timing is difficult to predict... program delays across several of our emerging GES opportunities [impacted sales].” — Ed Richardson, CEO (FY2024 Earnings Call)

Management commentary on this in their FY2024 call aligns with this narrative.

Why is this changing?

Management was able to steer the GES segment back on track in FY2025, growing sales in the division 30% from their down year in 2024 and getting gross margins back to their long term target of 30-35%.

In a short amount of time, we have designed numerous products, received several patents, and developed a growing list of key customers. All of this will help develop a more predictable quarterly revenue stream. […] In FY 2024, we saw the market share grow with an agreement to outfit 1,000 diesel locomotives with our patent-pending starter module. In addition, our pitch energy modules were selected by four new wind turbine platforms, including Suzlon, Senvion, Nordex, and SSB.

We now have over 18 wind turbine owner-operators purchasing numerous products from us, and we are expanding globally with the rollout of the new wind turbine platforms in Europe, Latin America, and Southeast Asia. Our customers repeatedly tell us that we have maintained our market share for our core GES power management applications, suggesting the slowdown in shipments in FY 2024 was primarily a timing issue. In fact, our customer pipeline and the number of opportunities continue to increase as we take advantage of significant energy transformation projects globally.

Over the first 2 quarters, of FY2026 this momentum is continuing with 1st half sales up 11% including a tough comp to Q125 that had a large one time EV locomotive order. Q2 26 was up a whopping 39% from Q2 26 with a book-to-bill of 1.1x which seems quite impressive on that growth.

They have several catalysts over the medium-long term that support this sales growth:

1. Partnered with Wabtec (diesel locomotives) to launch the “StartSaver” module, moving from their EV pilots to the mass-market retrofit of thousands of diesel locomotives.

2. Wind Expansion into non-GE turbine platforms (Suzlon, Senvion, Nordex) unlocks a new $150M+ addressable market in Europe and Latin America.

3. Existing wind customers are beginning to upgrade to the new “UltraPEM” modules, creating a second wave of sales from the same installed base. Management anticipates “new significant orders” specifically for this product. In addition, they are anticipating orders from new customers and expansion into the EU.

4. The company is launching its “Phase 1” commercial battery storage systems in Illinois right now (H1 CY2026) to capture state incentives. This would provide them an entry into Energy Storage Solutions (ESS), a very hot sector and lots of potential here with the direction the world is heading.

Obviously, a lot of exciting stuff and I think they should be on track to hit growth in the 20-30% range for this year and next based on these initiatives.

I will conclude with one note though. Its funny I look at other writeups on RELL over the years and this segment is always in the focus. Naturally, it makes sense - its the fastest growing, exposed to secularly growing industries, solid customer base, and good margins. I think for the long term story 3-5+ year view I fully agree but frankly I’m taking a shorter term view here specifically over the next 8-12 months so I believe the above catalysts are more important and I don’t need anything heroic from GES - as long as there are no surprises and steady growth I think the overall thesis will work here.

Management execution over the years has clearly been inconsistent so as exciting as the prospects in this division look I want to underwrite low expectations here and focus on the proven aspects of the company. Clearly market agrees here as they are ascribing almost zero value to the prospects and growth of this segment, will RELL prove them wrong? I hope but its not a question I feel confident answering.

4. Management

Speaking of management - the governance is a notable concern here. The dual-class share structure grants CEO Edward Richardson over 60% of the voting rights, as he holds 98% of the Class B shares (which carry 10x the voting power of Class A). He has essentially spent his entire working life at the company and owns 16% of the equity. However, at age 83, there are valid questions regarding his ability to lead the company through its lofty growth ambitions and manage the eventual succession. That said, the broader board and management team are quite tenured and experienced within the industry.

Capital allocation has also been questionable. The company has a history of poor M&A (lord knows what they were doing with the healthcare division) which was allowed to burn shareholder money for a decade. Despite paying a dividend, the company is typically overly conservative with its cash. Furthermore, ~70% of their current cash is held outside the U.S. in various legal entities; because this capital is required to stay offshore, the actual cash available to return to shareholders is significantly lower. Management’s priority is to invest in growth initiatives, primarily in the alternative and green energy segments, so I wouldn’t hold my breath on share buybacks (even though they make a lot of sense here considering the valuation).

From an engineering perspective, however, there is clearly incredible talent within the ranks. Richardson Electronics makes great products and boasts deep-seated relationships with several billion-dollar “blue chip” companies, so they are clearly doing things right on the customer side.

Ultimately, it’s a mixed bag, as is often the case with these longstanding microcaps. However, in my opinion, nothing here is extreme enough to make it uninvestable at these levels.

Valuation:

I have built out two models to roughly project what the 2027 numbers could look like. I have baked in pretty conservative numbers for my revenue estimates. Determining the right OpEx was the challenge. I referenced how opex as % of sales looked from their best years but increased them by roughly 3–5% to account for inflation and R&D spend, while also factoring in the removal of the Healthcare drag and the operating leverage of their semi business.

Applying an appropriate multiple on earnings is difficult here, but the current market narrative provides strong clues. The current consensus is that semiconductor demand is secular and will take years to build out. One look at RELLs biggest PMT customer (LAM) paints the picture of a what can happen to stock when the market views it as a secular story. LAM is up 3x in under a year and the is stock trading at 45x TTM and 35x forward earnings both historically high valuations for the company.

Even a pure distributor like Arrow Electronics (ARW) has seen its multiple expand significantly (15x–20x TTM earnings) due to its semi exposure, despite having half the margin profile of RELL and a slower growth trajectory.

Based on this, I believe the semi business should trade at a higher multiple than it has historically. Additionally, four factors suggest the entire enterprise deserves a premium:

The GES segment looks on track to grow sales at 20%+ while capitalizing on very hot themes (alternative energy, solar, power grid, ESS).

There is no longer a healthcare business dragging on profitability, which will be immediately accretive to margins.

Peak EPS (excluding one-time items) was already $1.02 in 2022 and $1.39 in 2023, proving the model works at scale.

Stronger emphasis on Engineering Solutions creates stickier/higher margin business

Price Targets

I think there is a strong case that RELL should trade at 20x+ earnings, but I will apply a conservative range of 18x–20x.

Base Case (2027): $13.86 – $15.40 (22% – 36% Upside)

Bull Case (2027): $20.34 – $22.60 (79% – 99% Upside)

2028 “Normalized” Scenario: Returning to peak EPS of $1.39: $25.02 – $27.80 (120% – 145% Upside)

Just a reminder, the company has no debt and is trading with ~20% of its market cap in cash.

With the stock at 1x Tangible Book Value and an NCAV around $8.97, I see very little downside in buying shares today at $11.35 and a very realistic chance at shares doubling in under 2 years.

Thus, I could be wrong, maybe even very wrong and it would still be difficult to lose much money. But the beauty here is that being even moderately right here could see material upside.

Risks

Management capital allocation

Semi cycle sentiment

GES growth hiccups

Good stuff

Thanks for the detailed write up. Great find!